Course: Finance Dnatube

share this page with the world.

Lec 1 - Introduction to interest

Introduction to interest What interest is. Simple versus compound interest.

Lec 2 - Interest (part 2)

Interest (part 2) More on simple and compound interest

Lec 3 - Introduction to Present Value

Introduction to Present Value A choice between money now and money later.

Lec 4 - Present Value 2

Present Value 2 More choices as to when you get your money.

Lec 5 - Present Value 3

Present Value 3 What happens when we change the discount rate?

Lec 6 - Present Value 4 (and discounted ...

Present Value 4 (and discounted cash flow) Lets change the discount rates depending on how far out the payments are.

Lec 7 - Introduction to Balance Sheets

Introduction to Balance Sheets Using a home purchase to illustrate assets, liabilities and owner's equity.

Lec 8 - More on balance sheets and equity

More on balance sheets and equity What happens to equity when the value of the assets increase or decrease

Lec 9 - Home equity loans

Home equity loans Simple example of borrowing from equity to fuel consumption

Lec 10 - Renting vs. Buying a home

Renting vs. Buying a home The math of renting vs. buying a home. Challenging the notion that it is always better to buy.

Lec 11 - Renting vs. buying a home (part 2)

Renting vs. buying a home (part 2) Factoring in appreciation and depreciation into the rent vs. buy decision.

Lec 12 - Renting vs. Buying (detailed an ...

Renting vs. Buying (detailed analysis) Detailed analysis of the rent vs. buy decision.

Lec 13 - The housing price conundrum

This lecture is provided by Khan Academy. Why did housing prices go up so much from 2000-2006 even though classical supply/demand would not have called for it

Lec 14 - Housing price conundrum (part 2)

This is a lecture of Khan Academy. How lower lending standards led to housing price inflation.

Lec 15 - Housing Price Conundrum (part 3)

This is a lecture of Khan Academy. Why did lending standards become more and more lax from 2000 to 2006?

Lec 16 - Housing Conundrum (part 4)

This is a lecture of Khan Academy. The virtuous circle of housing price appreciation making defaults go down making lending lax making housing appreciate even more

Lec 17 - What it means to buy a company' ...

What it means to buy a company's stock What it means to buy a company's stock

Lec 18 - Bonds vs. Stocks

This is a lecture of Khan Academy. Bonds vs. Stocks The difference between a bond and a stock.

Lec 19 - Shorting Stock

Shorting Stock What does it mean to short a stock?

Lec 20 - Shorting Stock 2

Shorting Stock 2 More on the mechanics of shorting stock.

Lec 21 - Is short selling bad?

Is short selling bad? A discussion of the virtues and/or vices of short selling.

Lec 22 - Chapter 7: Bankruptcy Liquidation

This is a lecture of Khan Academy. Chapter 7: Bankruptcy Liquidation Introduction to bankruptcy liquidation (Chapter 7)

Lec 23 - Chapter 11: Bankruptcy Restruct ...

This is a lecture of Khan Academy. Chapter 11: Bankruptcy Restructuring Chapter 11: Restructuring through a bankruptcy

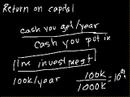

Lec 24 - Return on capital

Return on capital Introduction to return on capital and cost of capital. Using these concepts to decide where to invest.

Lec 25 - Credit Default Swaps (CDS) Intro

Credit Default Swaps (CDS) Intro Introduction to credit default swaps and why they can be dangerous

Lec 26 - Mortgage Back Security Overview

Mortgage Back Security Overview Basics of how a mortgage back security works

Lec 27 - Collateralized Debt Obligation ...

Collateralized Debt Obligation Overview How CDOs can give different investors different levels of risk and returns with the same underlying assets

Le 28 - Mortgage-Backed Securities I

This is a lecture of Khan Academy. Part I of the introduction to mortgage-backed securities

Lec 29 - Mortgage-backed securities II

This is a lecture of Khan Academy. Part II of the introduction to mortgage-backed securities

Lec 30 - Mortgage-backed securities III

This is a lecture of Khan Academy. More on mortgage-backed securities

Lec 31 - Collateralized Debt Obligation ...

This is a lecture of Khan Academy. Collateralized Debt Obligation (CDO) Introduction to collateralized debt obligations (to be listen to after series on mortgage-backed securities.

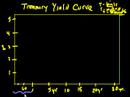

Lec 32 - Introduction to the yield curve

Introduction to the yield curve Introduction to the treasury yield curve.

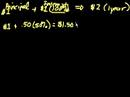

Lec 33 - Introduction to compound intere ...

Introduction to compound interest and e Compounding interest multiple times a year.

Lec 34 - Compound Interest and e (part 2)

Compound Interest and e (part 2) Compounding 100% annual interest continuously over a year converges to e (2.71...)

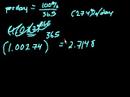

Lec 35 - Compound Interest and e (part 3)

Compound Interest and e (part 3) Continuously compounding $P in principal at an annual interest rate of r for a year ends up with a final payment of $Pe^r

Lec 36 - Compound Interest and e (part 4)

Compound Interest and e (part 4) Continuously compounding for multiple years.

Lec 37 - Bailout 1: Liquidity vs. Solvency

This is a lecture of Khan Academy. Bailout 1: Liquidity vs. Solvency Review of balance sheets. Difference between illiquidity and insolvency.

Lec 38 - Bailout 2: Book Value

This is a lecture of Khan Academy. Bailout 2: Book Value Hypothetical bank balance sheet. What book value means.

Lec 39 - Bailout 3: Book value vs. marke ...

This is a lecture of Khan Academy. Bailout 3: Book value vs. market value What it means when the market value of a stock is different from its book value.

Lec 40 - Bailout 4: Mark-to-model vs. ma ...

This is a lecture of Khan Academy. Bailout 4: Mark-to-model vs. mark-to-market Different ways of accounting for an asset. Mark-to-model vs. mark-to-market.

Lec 41 - Bailout 5: Paying off the debt

This is a lecture of Khan Academy. Bailout 5: Paying off the debt How the bank can liquidate assets to pay off debt that comes due.

Lec 42 - Bailout 6: Getting an equity in ...

This is a lecture of Khan Academy. Bailout 6: Getting an equity infusion The bank gets bailed out by an equity infusion from a sovereign wealth fund.

Lec 43 - Bailout 7: Bank goes into bankr ...

This is a lecture of Khan Academy. Bailout 7: Bank goes into bankruptcy What happens when there is no equity infusion and the bank goes in to bankruptcy.

Lec 44 - Bailout 8: Systemic Risk

This is a lecture of Khan Academy. Bailout 8: Systemic Risk How the banks are connected. What happens when one bank fails.

Lec 45 - Bailout 9: Paulson's Plan

This is a lecture of Khan Academy. Bailout 9: Paulson's Plan What Paulson wants to do and why I don't like it.

Lec 46 - Bailout 10: Moral Hazard

Alternate plans and moral hazard is shown in the Khan Academy lecture.

Lec 47 - Credit Default Swaps

This is a lecture of Khan Academy. Credit Default Swaps Introduction to credit default swaps

Lec 48 - Credit Default Swaps 2

This is a lecture of Khan Academy. Credit Default Swaps 2 Systemic risks of credit default swaps. Financial weapons of mass destruction.

Lec 49 - Investment vs. Consumption 1

Investment vs. Consumption 1 The difference between investment and consumption.

Lec 50 - Investment vs. Comsumption 2

Investment vs. Comsumption 2 More investment vs. consumption examples.

Lec 51 - Bailout 11: Why these CDOs coul ...

Why a CDO could be worth nothing even though they are "collateralized" is shown in this Khan Academy lecture.

Lec 52 - Bailout 12: Lone Star Transaction

A real life example of a transaction involving CDOs is shown in this Khan Academy lecture.

Lec 53 - Bailout 13: Does the bailout ha ...

This is a lecture of Khan Academy. Bailout 13: Does the bailout have a chance of working? Can the bailout work?

Lec 54 - Wealth Destruction 1

This lecture is provided by Khan Academy. How bubbles destroy wealth is explained in this lecture.

Lec 55 - Wealth Destruction 2

This lecture is provided by Khan Academy. How bubbles destroy wealth.

Lec 56 - Bailout 14: Possible Solution

This is a lecture of Khan Academy. . Bailout 14: Possible Solution A solution that is MUCH fairer that has a MUCH better chance of working!

Lec 57 - Bailout 15: More on the solution

This is a lecture of Khan Academy. Bailout 15: More on the solution More on the "Plutsky Plan".

Lec 58 - Banking 1

This is a lecture of Khan Academy. Banking 1 Introduction to how banks make money and the value they (potentially) add to society.

Lec 59 - Banking 2: A bank's income stat ...

This is a lecture of Khan Academy. Banking 2: A bank's income statement Introduction to the income statement of a bank (and to income statements in general).

Lec 60 - Banking 3: Fractional Reserve B ...

This is a lecture of Khan Academy. Banking 3: Fractional Reserve Banking Fractional reserve banking and the multiplier effect. Introduction to the money supply.

Lec 61 - Banking 4: Multiplier effect an ...

This is a lecture of Khan Academy. Banking 4: Multiplier effect and the money supply How "money" is created in a fractional reserve banking system. M0 and M1 definitions of the money suppy. The multiplier effect.

Lec 62 - Personal Bankruptcy: Chapters ...

Personal Bankruptcy: Chapters 7 and 13 Chapter 7 and Chapter 13 personal bankruptcy. This video was sponsored by Visa, but I had complete editorial freedom as to its contents.

Lec 63 - Introduction to Compound Interest

Introduction to Compound Interest Introduction to compound interest

Lec 64 - The Rule of 72 for Compound Int ...

The Rule of 72 for Compound Interest Using the Rule of 72 to approximate how long it will take for an investment to double at a given interest rate

Lec 65 - Annual Percentage Rate (APR) an ...

Annual Percentage Rate (APR) and Effective APR The difference between APR and effective APR

Lec 66 - Introduction to Bonds

Introduction to Bonds What it means to buy a bond

Lec 67 - Relationship between bond price ...

Relationship between bond prices and interest rates Why bond prices move inversely to changes in interest rate

Lec 68 - Introduction to Mortgage Loans

Introduction to Mortgage Loans Introduction to mortgage loans

Lec 69 - Traditional IRAs

Traditional IRAs Introduction to traditional IRA's (Individual Retirement Accounts)

lEC 70 - Roth IRAs

Roth IRAs Introduction to Roth IRA's

Lec 71 - 401(k)s

401(k)s 401(k)s (and how they compare to IRAs)

Lec 72 - Payday Loans

Payday Loans How Payday lending works

Lec 73 - Institutional Roles in Issuing ...

Institutional Roles in Issuing and Processing Credit Cards The institutions involved in processing your credit credit and how they relate to each other

Lec 74 - Ponzi Schemes

Ponzi Schemes Ponzi Schemes

Lec 75 - Currency Exchange Introduction

This is a lecture of Khan Academy. Introduction to how exchange rates can fluctuate

Lec 76 - Currency Effect on Trade

This is a lecture of Khan Academy. Currency Effect on Trade

Lec 77 - Currency Effect on Trade Review

This is a lecture of Khan Academy. Currency Effect on Trade Review

Lec 78 - Pegging the Yuan

This is a lecture of Khan Academy. How the Chinese Central Bank could peg the Yuan to the dollar by printing Yuan and buying dollars (building up a dollar reserve)

Lec 79 - Chinese Central Bank Buying Tre ...

This is a lecture of Khan Academy. Chinese Central Bank Buying Treasuries

Lec 80 - American-Chinese Debt Loop

How the Chinese buying of American debt leads to lower interest rates is shown in this Khan Academy lecture.

Lec 81 - Debt Loops Rationale and Effects

This is a lecture of Khan Academy. Positive and negative effects of China's devaluing of their currency

Lec 82 - American Call Options

American Call Options American Call Options

Lec 83 - Basic Shorting

Basic Shorting Basic Shorting

Lec 84 American Put Options

American Put Options American Put Options

Lec 85 - Call Option as Leverage

Call Option as Leverage Call Option as Leverage

Lec 86 - Put vs. Short and Leverage

Put vs. Short and Leverage Put vs. Short and Leverage

Lec 87 Call Payoff Diagram

Call Payoff Diagram Call Payoff Diagram

Lec 88 Put Payoff Diagram

Put Payoff Diagram Put Payoff Diagram

Lec 89 - Long Straddle

Long Straddle Long Straddle

Lec 90 - Put as Insurance

Put as Insurance Put as Insurance

Lec 91- Put-Call Parity

Put-Call Parity Put-Call Parity

Lec 92 - Put Writer Payoff Diagrams

Put Writer Payoff Diagrams Put Writer Payoff Diagrams

Lec 93 - Call Writer Payoff Diagram

Call Writer Payoff Diagram Call Writer Payoff Diagram

Lec 94 - Arbitrage Basics

Arbitrage Basics Arbitrage Basics

Lec 95 - Put-Call Parity Arbitrage I

Put-Call Parity Arbitrage I Put-Call Parity Arbitrage I

Lec 96 - Put-Call Parity Arbitrage II

Put-Call Parity Arbitrage II Put-Call Parity Arbitrage II

Lec 97 - Put-Call Parity Clarification

Put-Call Parity Clarification Put-Call Parity Clarification

Lec 98 - Actual Option Quotes

Actual Option Quotes Actual Option Quotes

Lec 99 - Option Expiration and Price

Option Expiration and Price Option Expiration and Price

Lec 100 - Forward Contract Introduction

Forward Contract Introduction Forward Contract Introduction

Lec 101 - Futures Introduction

Futures Introduction Futures Introduction

Lec 102 - Motivation for the Futures Exc ...

Motivation for the Futures Exchange How an exchange can benefit from trading futures and how it can use margin to mitigate its risk

Lec 103 - Futures Margin Mechanics

Futures Margin Mechanics Understanding the mechanics of margin for futures. Initial and maintenance margin

Lec 104 - Verifying Hedge with Futures M ...

Verifying Hedge with Futures Margin Mechanics Verifying Hedge with Futures Margin Mechanics

Lec 105 - Futures and Forward Curves

Futures and Forward Curves Normal and Inverted Futures Curves

Lec 106 - Contango from Trader Perspective

Contango from Trader Perspective What a trader means when they say that a market is in contango

Lec 107 - Severe Contango Generally Bearish

Severe Contango Generally Bearish Thinking about why a severe contango could be bearish

Lec 108 - Backwardation Bullish or Bearish

Backwardation Bullish or Bearish Thinking about why backwardation in commodities markets is bullish

Lec 109 - Futures Curves II

Futures Curves II Futures Curves II

Lec 110 - Contango

Contango

Lec 111 - Backwardation

Backwardation Backwardation and the theory of Normal Backwardation

Lec 112 - Contango and Backwardation Review

Contango and Backwardation Review Review of the difference uses of the words contango, backwardation, contango theory and theory of normal backwardation

Lec 113 - Upper Bound on Forward Settlem ...

Upper Bound on Forward Settlement Price Upper Bound on Forward Settlement Price

Lec 114 - Lower Bound on Forward Settlem ...

Lower Bound on Forward Settlement Price Lower Bound on Forward Settlement Price

Lec 115 - Arbitraging Futures Contract

Arbitraging Futures Contract

Lec 116 - Arbitraging Futures Contracts II

Arbitraging Futures Contracts II Arbitraging Futures Contracts II

Lec 117 - Cash Accounting

Cash Accounting Simple example of cash accounting

Lec 118 - Accrual Basis of Accounting

Accrual Basis of Accounting Simple example of accrual accounting

Lec 119 - Comparing Accrual and Cash Acc ...

Comparing Accrual and Cash Accounting Comparing Accrual and Cash Accounting

Lec 120 - Balance Sheet and Income State ...

Balance Sheet and Income Statement Relationship Balance Sheet and Income Statement Relationship

Lec 121 - Basic Cash Flow Statement

Basic Cash Flow Statement Using a cash flow statement to reconcile net income with change in cash

Lec 122 - Doing the example with Account ...

Doing the example with Accounts Payable growing Introduction to Accounts Payable

Lec 123 - Expensing a Truck leads to inc ...

Expensing a Truck leads to inconsistent performance Expensing a truck leads to strange looking income statement

Lec 124 - Depreciating the truck

Depreciating the truck Depreciation the truck spreads out the expense

Lec 125 - Depreciation in Cash Flow

Depreciation in Cash Flow Depreciation in Cash Flow

Lec 126 - Amortization and Depreciation

Amortization and Depreciation Comparing depreciation and amortization

Lec 127 - Basic Capital Structure Differ ...

Basic Capital Structure Differences Understanding basic capital structure differences

Lec 128 - Market Capitalization

Market Capitalization Market versus book value of equity

Lec 129 - Market Value of Assets

Market Value of Assets Market value of assets.

Lec 130 - LIBOR

This lecture is provided by Khan Academy. London InterBank Offer Rate

Lec 131 - Fair Value Accounting

Fair Value Accounting Difference between Historical Cost and Fair Value Accounting

Lec 132 - Tax Deductions Introduction

Tax Deductions Introduction Understanding what a tax deduction is

Lec 133 - Alternative Minimum Tax

Alternative Minimum Tax The basics of the alternative minimum tax

Lec 134 - Term Life Insurance and Death ...

This lecture is provided by Khan Academy. Understanding an insurance company's sense of my chances of dying.

Lec 135 - Back of Envelope Office Space ...

Back of Envelope Office Space Conundrum Back of the envelope calculation of which office space to rent

Lec 136 - Corporations and Limited Liability

Corporations and Limited Liability Why people set up corporations

Lec 137 - Is Limited Liability or Double ...

Is Limited Liability or Double Taxation Fair Thinking about whether limited liability or double taxation fair

Lec 138 - Open-Ended Mutual Fund (Part 1)

Open-Ended Mutual Fund (Part 1) Introduction to Open-Ended Mutual Funds

Lec 139 - Open-End Mutual Fund Redemptions

Open-End Mutual Fund Redemptions Understanding the mechanics of an open end mutual fund a bit better

Lec 140 - Closed-End Mutual Funds

Closed-End Mutual Funds Comparing closed-end and open-ended mutual funds

Lec 141 - Exchange Traded Funds (ETFs)

Exchange Traded Funds (ETFs) Comparing ETF's, open-end, and closed-end funds

Lec 142 - Hedge Funds Intro

Hedge Funds Intro Overview of how hedge funds are different than mutual funds

Lec 143 - Hedge Fund Structure and Fees

Hedge Fund Structure and Fees Understanding how hedge funds are structured and how the managers get paid

Lec 144 - Are Hedge Funds Bad?

Are Hedge Funds Bad? Thinking about how hedge funds are different from other institutions

Lec 145 - Hedge Funds, Venture Capital, ...

Hedge Funds, Venture Capital, and Private Equity Similarities in compensation structure for hedge funds, venture capital firms, and private equity investors

Lec 146 - Treasury Bond Prices and Yields

Treasury Bond Prices and Yields Why yields go down when prices go up

Lec 147 - Annual Interest Varying with D ...

Annual Interest Varying with Debt Maturity Annual Interest Varying with Debt Maturity

Lec 148 - The Yield Curve

The Yield Curve The Yield Curve

Lec 149 - Fed Open Market Operations

Fed Open Market Operations Fed Open Market Operations

Lec 150 - Quantitative Easing

Quantitative Easing Overview of quantitative easing

Lec 151 - More on Quantitative Easing (a ...

More on Quantitative Easing (and Credit Easing) Understanding the difference between quantitative easing in Japan and the United States

Lec 152 - Hedge Fund Strategies - Long S ...

Hedge Fund Strategies - Long Short 1 Setting up a simple long-short hedge (assuming the companies have similar beta or correlation with market)

Lec 153 - Hedge Fund Strategies - Long S ...

Hedge Fund Strategies - Long Short 2 Seeing how the long-short portfolio might do in different market conditions (assuming that the underlying thesis is right)

Lec 154 - Hedge Fund Strategies - Merge ...

Hedge Fund Strategies - Merger Arbitrage 1 Simple case of merger arbitrage when there is an all cash acquisition

Lec 155 - Stock Dilution

Stock Dilution Why the value per share does not really get diluted when more shares are issued in a secondary offering

Lec 156 - Acquisitions with Shares

Acquisitions with Shares Mechanics of a share-based acquisition

Lec 157 - Price Behavior After Announced ...

Price Behavior After Announced Acquisition Stock Price Behavior After Announced Acquisition with Shares

Lec 158 - Simple Merger Arb with Share A ...

Simple Merger Arb with Share Acquisition Showing how a merger arbitrage player might act if they were sure that a transaction would go through

Lec 159 - Basic Leveraged Buyout (LBO)

Basic Leveraged Buyout (LBO) The mechanics of a simple leveraged buy-out

Lec 160 - Corporate Debt versus Traditio ...

Corporate Debt versus Traditional Mortgages Understanding how most corporate debt is different than most personal mortgages

Lec 161 - AMT Overview

AMT Overview Overview of what the Alternative Minimum Tax is and its purpose

Lec 162 - Open market operations and Qua ...

Open market operations and Quantitative Easing Overview Basic difference between traditional open market operations and quantitative easing.

Lec 163 - Another Quantitative Easing Video

Another Quantitative Easing Video More on quantitative easing

Lec 164 - US and Japanese Quantitative E ...

US and Japanese Quantitative Easing Comparing quantitative easing in Japan to "credit easing" in the United States

Lec 165 - Term and Whole Life Insurance ...

Term and Whole Life Insurance Policies 2 What happens to the cash payout in a whole life policy when someone dies?

Lec 166 - Term and Whole Life Insurance ...

Term and Whole Life Insurance Policies Overview of the difference between term and whole life insurance policies

Lec 167 - Estate Tax Introduction

Estate Tax Introduction Overview of the estate tax

Lec 168 - Human Capital

Human Capital Basic overview of capital and human capital

Lec 169 - Risk and Reward Introduction

Risk and Reward Introduction Basic introduction to risk and reward

Lec 170 - Futures Fair Value in the Pre- ...

Futures Fair Value in the Pre-Market What is the Futures Fair Value and how to traders use it as an indicator for stock price direction at market opening

Lec 171 - What is Inflation

What is Inflation The basics of what price inflation is and how the CPI-U is calculated

Lec 172 - Inflation Data

Inflation Data Looking at actual sequential and year-over-year inflation data

Lec 173 - Moderate Inflation in a Good E ...

Moderate Inflation in a Good Economy Why there tends to be moderate inflation during good economies

Lec 174 - Stagflation

Stagflation How a supply shock can cause prices to rise and the economy to stagnate

Lec 175 - Real and Nominal Return

Real and Nominal Return Inflation and real and nominal return

Lec 176 - Calculating Real Return in Las ...

Calculating Real Return in Last Year Dollars Calculating real return in last year dollars

Lec 177 - Relation Between Nominal and R ...

Relation Between Nominal and Real Returns and Inflation Relation between nominal and real returns and inflation

Lec 178 - Use Cases for Credit Default Swaps

Use Cases for Credit Default Swaps How credit default swaps can be used as hedges, insurance or side-bets

Lec 179 - Financial Weapons of Mass Dest ...

Financial Weapons of Mass Destruction Why Warren Buffett called Credit Default Swaps financial weapons of mass destruction

Lec 180 - Deflation

Deflation Basics of deflation

Lec 181 - Velocity of Money Rather than ...

Velocity of Money Rather than Quantity Driving Prices How velocity of money can drive price increases

Lec 182 - Deflation Despite Increases in ...

Deflation Despite Increases in Money Supply How you can have deflation even if the money supply increases

Lec 183 - Deflationary Spiral

Deflationary Spiral Basics of a deflationary spiral

Lec 184 - Hyperinflation

Hyperinflation Basic of hyperinflation. Weimar Germany, Hungarian Pengo and Zibabwean Dollar

Lec 185 - Estate Tax Basics

Estate Tax Basics Overview of the inheritance tax

Lec 186 - Term and Whole Life

Term and Whole Life The difference between term and whole life insurance

Lec 187 - Open-Ended Mutual Funds

Open-Ended Mutual Funds Mutual fund basic

Lec 188 - Unemployment Rate Primer (v2)

Unemployment Rate Primer (v2) How the unemployment rate is calculated

Lec 189 - Time Value of Money

Time Value of Money Why when you get your money matters as much as how much money. Present and future value also discussed.

Lec 190 - Mortgage Interest Rates

Mortgage Interest Rates Understanding how mortgage interest rates are quoted

Lec 191 - Inflation Overview

Inflation Overview Basic understanding of Inflation

Lec 192 - Basics of US Income Tax Rate S ...

Basics of US Income Tax Rate Schedule Understanding that a marginal tax rate does not apply to all of income

Lec 193 - Carry Trade Basics

Carry Trade Basics The mechanics of the carry trade

Lec 194 - Interpretting Futures Fair Val ...

Interpretting Futures Fair Value in the PreMarket How to interpret the market price of a futures contract relative to the fair value in the premarket

Lec 195 - Interest Rate Swap 1

Interest Rate Swap 1 The basic dynamic of an interest rate swap

Lec 196 - Interest Rate Swap 2

Interest Rate Swap 2

Finance

Source of these courses is khan

This is Finance course from Khan University. These lectures show videos on finance and macroeconomics.

khan Website: http://www.dnatube.com/school/khan