Lec 145 - Hedge Funds, Venture Capital, and Private Equity

Hedge Funds, Venture Capital, and Private Equity Similarities in compensation structure for hedge funds, venture capital firms, and private equity investors

Video is embedded from external source so embedding is not available.

Video is embedded from external source so download is not available.

Channels: Finance

Tags: Hedge Funds, Venture Capital, and Private Equity

Uploaded by: khanfinance ( Send Message ) on 06-09-2012.

Duration: 2m 54s

Lec 142 - Hedge Funds Intro

03:32 | 2143 viewsLec 144 - Are Hedge Funds Bad?

07:50 | 1873 viewsLec 10 - A New Vision for Capital Markets

54:57 | 3011 viewsLec 25 - Venture Finance, Part 1

10:16 | 2932 viewsLec 27 - Venture Finance, Part 3

21:45 | 2611 viewsLec 143 - Hedge Fund Structure and Fees

06:51 | 2137 viewsLec 26 - Venture Finance, Part 2

12:44 | 2517 viewsLec 9 -Year 2008 - Guest Lecture by Davi ...

01:11:24 | 3564 viewsLec 20 -Year 2008 - Guest Lecture by Step ...

01:09:08 | 2629 viewsLec 8 - More on balance sheets and equity

10:05 | 2328 viewsLec 9 - Home equity loans

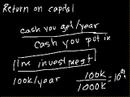

08:36 | 2468 viewsLec 24 - Return on capital

09:48 | 2595 viewsLec 42 - Bailout 6: Getting an equity inf ...

12:02 | 2449 viewsLec 104 - Verifying Hedge with Futures Ma ...

03:48 | 2329 viewsLec 127 - Basic Capital Structure Differences

04:01 | 2646 viewsNo content is added to this lecture.

This video is a part of a lecture series from of khan

Lecture list for this course

Lec 1 - Introduction to interest

Lec 3 - Introduction to Present Value

Lec 6 - Present Value 4 (and discounted cash flow)

Lec 7 - Introduction to Balance Sheets

Lec 8 - More on balance sheets and equity

Lec 10 - Renting vs. Buying a home

Lec 11 - Renting vs. buying a home (part 2)

Lec 12 - Renting vs. Buying (detailed analysis)

Lec 13 - The housing price conundrum

Lec 14 - Housing price conundrum (part 2)

Lec 15 - Housing Price Conundrum (part 3)

Lec 16 - Housing Conundrum (part 4)

Lec 17 - What it means to buy a company's stock

Lec 21 - Is short selling bad?

Lec 22 - Chapter 7: Bankruptcy Liquidation

Lec 23 - Chapter 11: Bankruptcy Restructuring

Lec 25 - Credit Default Swaps (CDS) Intro

Lec 26 - Mortgage Back Security Overview

Lec 27 - Collateralized Debt Obligation Overview

Le 28 - Mortgage-Backed Securities I

Lec 29 - Mortgage-backed securities II

Lec 30 - Mortgage-backed securities III

Lec 31 - Collateralized Debt Obligation (CDO)

Lec 32 - Introduction to the yield curve

Lec 33 - Introduction to compound interest and e

Lec 34 - Compound Interest and e (part 2)

Lec 35 - Compound Interest and e (part 3)

Lec 36 - Compound Interest and e (part 4)

Lec 37 - Bailout 1: Liquidity vs. Solvency

Lec 38 - Bailout 2: Book Value

Lec 39 - Bailout 3: Book value vs. market value

Lec 40 - Bailout 4: Mark-to-model vs. mark-to-market

Lec 41 - Bailout 5: Paying off the debt

Lec 42 - Bailout 6: Getting an equity infusion

Lec 43 - Bailout 7: Bank goes into bankruptcy

Lec 44 - Bailout 8: Systemic Risk

Lec 45 - Bailout 9: Paulson's Plan

Lec 46 - Bailout 10: Moral Hazard

Lec 48 - Credit Default Swaps 2

Lec 49 - Investment vs. Consumption 1

Lec 50 - Investment vs. Comsumption 2

Lec 51 - Bailout 11: Why these CDOs could be worth nothing

Lec 52 - Bailout 12: Lone Star Transaction

Lec 53 - Bailout 13: Does the bailout have a chance of working?

Lec 56 - Bailout 14: Possible Solution

Lec 57 - Bailout 15: More on the solution

Lec 59 - Banking 2: A bank's income statement

Lec 60 - Banking 3: Fractional Reserve Banking

Lec 61 - Banking 4: Multiplier effect and the money supply

Lec 62 - Personal Bankruptcy: Chapters 7 and 13

Lec 63 - Introduction to Compound Interest

Lec 64 - The Rule of 72 for Compound Interest

Lec 65 - Annual Percentage Rate (APR) and Effective APR

Lec 66 - Introduction to Bonds

Lec 67 - Relationship between bond prices and interest rates

Lec 68 - Introduction to Mortgage Loans

Lec 73 - Institutional Roles in Issuing and Processing Credit Cards

Lec 75 - Currency Exchange Introduction

Lec 76 - Currency Effect on Trade

Lec 77 - Currency Effect on Trade Review

Lec 79 - Chinese Central Bank Buying Treasuries

Lec 80 - American-Chinese Debt Loop

Lec 81 - Debt Loops Rationale and Effects

Lec 82 - American Call Options

Lec 85 - Call Option as Leverage

Lec 86 - Put vs. Short and Leverage

Lec 92 - Put Writer Payoff Diagrams

Lec 93 - Call Writer Payoff Diagram

Lec 95 - Put-Call Parity Arbitrage I

Lec 96 - Put-Call Parity Arbitrage II

Lec 97 - Put-Call Parity Clarification