Lec 6 -Year 2008 - Efficient Markets vs. Excess Volatility

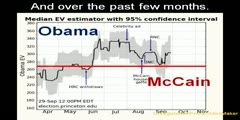

Efficient Markets vs. Excess Volatility Financial Markets (ECON 252) -Year 2008 Several theories in finance relate to stock price analysis and prediction. The efficient markets hypothesis states that stock prices for publicly-traded companies reflect all available information. Prices adjust to new information instantaneously, so it is impossible to "beat the market." Furthermore, the random walk theory asserts that changes in stock prices arise only from unanticipated new information, and so it is impossible to predict the direction of stock prices. Using statistical tools, we can attempt to test the hypotheses and to predict future stock prices. These tests show that efficient markets theory is a half-truth: it is difficult but not impossible for some people to beat the market. 00:00 - Chapter 1. Last Thoughts on Insurance and Catastrophe Bonds 06:28 - Chapter 2. Information Access and the Efficient Markets Hypothesis 20:00 - Chapter 3. Varying Degrees of Efficient Markets and No Dividends: The Case of First Federal Financial 41:44 - Chapter 4. The Random Walk Theory 51:30 - Chapter 5. The First Order Auto-regressive Model 56:59 - Chapter 6. Challenges in Forecasting the Market Complete course materials are available at the Open Yale Courses website: http://open.yale.edu/courses This course was recorded in Spring 2008.

Video is embedded from external source so embedding is not available.

Video is embedded from external source so download is not available.

Channels: Finance

Tags: AR-1 efficient markets hypothesis first order auto-regressive model random walk theory stock market prices volatility

Uploaded by: yalefinanmarkets ( Send Message ) on 20-08-2012.

Duration: 68m 18s

Here is the next lecture for this course

Lec 7 - Efficient Markets

01:07:45 | 2484 viewsLec 17 - Options Markets

01:11:57 | 2431 viewsTheory of Metallic Conduction: Biased Ran ...

00:12 | 5962 viewsLec 13 - Demography and Asset Pricing: Wi ...

01:12:22 | 2595 viewsLec 15 - Forward and Futures Markets

01:12:37 | 2635 viewsAfter the Failed Bailout and Stock Market ...

05:00 | 2915 viewsLec 11 - Law 270.6 Deregulation and Mark ...

01:11:00 | 2501 viewsLec 10 - A New Vision for Capital Markets

54:57 | 3010 viewsLec 12 - Law 270.6 Climate Change and Ca ...

02:32:14 | 3121 viewsLec 1- Why Finance?

01:14:17 | 2008 viewsLec 4 - Portfolio Diversification and Sup ...

01:18:01 | 2524 viewsLec 14 - Deregulation and Markets & Env I ...

02:37:19 | 2010 viewsLec 40 - Bailout 4: Mark-to-model vs. mar ...

11:24 | 2823 viewsLec 4 - Bailout 4: Mark-to-model vs. mark ...

11:24 | 2238 viewsLec 83 - Carnot Efficiency 3: Proving th ...

12:17 | 2454 viewsNo content is added to this lecture.

This video is a part of a lecture series from of Yale

Lecture list for this course

Lec 1-Year 2008 Finance and Insurance as Powerful Forces in Our

Lec 2 -Year 2008 - The Universal Principle of Risk Management: Pooling

Lec 3 -Year 2008 - Technology and Invention in Finance

Lec 4 -Year 2008 - Portfolio Diversification and Supporting Financial

Lec 5 -Year 2008 - Insurance: The Archetypal Risk Management

Lec 7 -Year 2008 - Behavioral Finance: The Role of Psychology

Lec 8 -Year 2008 - Human Foibles, Fraud, Manipulation, and Regulation

Lec 9 -Year 2008 - Guest Lecture by David Swensen

Lec 10 -Year 2008 - Debt Markets: Term Structure

Lec 12 -Year 2008 - Real Estate Finance and its Vulnerability to Crisis

Lec 13 -Year 2008 - Banking: Successes and Failures

Lec 14 -Year 2008 - Guest Lecture by Andrew Redleaf

Lec 15 -Year 2008 - Guest Lecture by Carl Icahn

Lec 16 -Year 2008 - The Evolution and Perfection of Monetary Policy

Lec 17 -Year 2008 - Investment Banking and Secondary Markets

Lec 18 -Year 2008 - Professional Money Managers and Their Influence

Lec 19 -Year 2008 - Brokerage, ECNs, etc.

Lec 20 -Year 2008 - Guest Lecture by Stephen Schwarzman

Lec 21 -Year 2008 - Forwards and Futures

Lec 22 -Year 2008 - Stock Index, Oil and Other Futures Markets

Lec 23 -Year 2008 - Options Markets

Lec 24 -Year 2008 - Making It Work for Real People: The Democratization

Lec 25 -Year 2008 - Learning from and Responding to Financial Crisis I

Lec 26 -Year 2008 Learning from and Responding to Financial Crisis II