Lec 17 - Callable Bonds and the Mortgage Prepayment Option

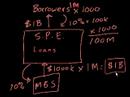

"Lec 17 - Callable Bonds and the Mortgage Prepayment Option" Financial Theory (ECON 251) This lecture is about optimal exercise strategies for callable bonds, which are bonds bundled with an option that allows the borrower to pay back the loan early, if she chooses. Using backward induction, we calculate the borrower's optimal strategy and the value of the option. As with the simple examples in the previous lecture, the option value turns out to be very large. The most important callable bond is the fixed rate amortizing mortgage; calling a mortgage means prepaying your remaining balance. We examine how high bankers must set the mortgage rate in order to compensate for the prepayment option they give homeowners. Looking at data on mortgage rates we see that mortgage borrowers often fail to prepay optimally. 00:00 - Chapter 1. Introduction to Callable Bonds and Mortgage Options 12:14 - Chapter 2. Assessing Option Value via Backward Induction 42:44 - Chapter 3. Fixed Rate Amortizing Mortgage 57:51 - Chapter 4. How Banks Set Mortgage Rates for Prepayers Complete course materials are available at the Open Yale Courses website: http://open.yale.edu/courses This course was recorded in Fall 2009.

Video is embedded from external source so embedding is not available.

Video is embedded from external source so download is not available.

Channels: Finance

Tags: Lec 17 - Callable Bonds and the Mortgage Prepayment Option

Uploaded by: yalefinancialth ( Send Message ) on 12-09-2012.

Duration: 72m 14s

Here is the next lecture for this course

Lec 18 - Modeling Mortgage Prepayments an ...

01:12:06 | 2542 viewsLec 19 - History of the Mortgage Market: ...

01:19:18 | 3585 viewsUnderstanding Benzene Resonance with Pi-bonds

00:13 | 13376 viewsChemical Science - Covalent Bonds - Lectu ...

47:12 | 16610 viewsDisulfide Bonds

00:36 | 7536 viewsOrbital hybridization in Sigma and pi bonds

06:33 | 8407 viewsOrbital hybridization. Sigma and pi bonds ...

10:49 | 9434 viewsWhat Are Elements Compounds And Chemical ...

02:16 | 6266 viewsImproved health and appearance; say No to ...

01:17 | 5651 viewsLec 18 - Bonds vs. Stocks

09:21 | 3553 viewsLec 26 - Mortgage Back Security Overview

02:03 | 3764 viewsLe 28 - Mortgage-Backed Securities I

07:56 | 3057 viewsLec 29 - Mortgage-backed securities II

09:34 | 3070 viewsLec 30 - Mortgage-backed securities III

09:17 | 3045 viewsLec 82 - Geometric series sum to figure o ...

17:36 | 3127 viewsNo content is added to this lecture.

This video is a part of a lecture series from of Yale

Lecture list for this course

Lec 2- Utilities, Endowments, and Equilibrium

Lec 4- Efficiency, Assets, and Time

Lec 5- Present Value Prices and the Real Rate of Interest

Lec 6 - Irving Fisher's Impatience Theory of Interest

Lec 7 - Shakespeare's Merchant of Venice and Collateral, Present Value and the Vocabulary of Finance

Lec 8 - How a Long-Lived Institution Figures an Annual Budget. Yield

Lec 10 - Dynamic Present Value

Lec 12 - Overlapping Generations Models of the Economy

Lec 13 - Demography and Asset Pricing: Will the Stock Market Decline when the Baby Boomers Retire?

Lec 14 - Quantifying Uncertainty and Risk

Lec 15 - Uncertainty and the Rational Expectations Hypothesis

Lec 16 - Backward Induction and Optimal Stopping Times

Lec 18 - Modeling Mortgage Prepayments and Valuing Mortgages

Lec 19 - History of the Mortgage Market: A Personal Narrative

Lec 21 - Dynamic Hedging and Average Life

Lec 22 - Risk Aversion and the Capital Asset Pricing Theorem

Lec 23 - The Mutual Fund Theorem and Covariance Pricing Theorems

Lec 24 - Risk, Return, and Social Security

Lec 25 - The Leverage Cycle and the Subprime Mortgage Crisis