Lec 4- Efficiency, Assets, and Time

"Lec 4- Efficiency, Assets, and Time" Financial Theory (ECON 251) Over time, economists' justifications for why free markets are a good thing have changed. In the first few classes, we saw how under some conditions, the competitive allocation maximizes the sum of agents' utilities. When it was found that this property didn't hold generally, the idea of Pareto efficiency was developed. This class reviews two proofs that equilibrium is Pareto efficient, looking at the arguments of economists Edgeworth, and Arrow-Debreu. The lecture suggests that if a broadening of the economic model invalidated the sum of utilities justification of free markets, a further broadening might invalidate the Pareto efficiency justification of unregulated markets. Finally, Professor Geanakoplos discusses how Irving Fisher introduced two crucial ingredients of finance,--time and assets--into the standard economic equilibrium model. 00:00 - Chapter 1. Is the Free Market Good? A Mathematical Perspective 11:20 - Chapter 2. The Pareto Efficiency and Equilibrium 38:42 - Chapter 3. Fundamental Theorem of Economics 46:27 - Chapter 4. Shortcomings of the Fundamental Theorem 52:39 - Chapter 5. History of Mathematical Economics 01:00:21 - Chapter 6. Elements of Financial Models Complete course materials are available at the Open Yale Courses website: http://open.yale.edu/courses This course was recorded in Fall 2009.

Video is embedded from external source so embedding is not available.

Video is embedded from external source so download is not available.

Channels: Finance

Tags: Lec 4- Efficiency, Assets, and Time

Uploaded by: yalefinancialth ( Send Message ) on 12-09-2012.

Duration: 71m 29s

Here is the next lecture for this course

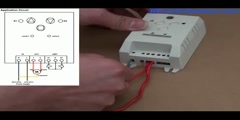

AC220V Time Delay Radio Motor Controller ...

03:28 | 6931 viewsReal Time PCR

03:03 | 34318 viewsThe first time machine

05:31 | 6841 viewsHow To Time Travel

04:09 | 5827 viewsTheory of relativity: space and time

05:42 | 10372 viewsIs Time Travel Possible

02:44 | 5982 viewsBefore Time and Space

03:28 | 8043 viewsTime Travel- Einsteinss big idea -Theory ...

04:11 | 8298 viewsLatitude, Longitude, and Time Zones

02:02 | 19580 viewsHow To Plot Velocity Time Graph?

02:52 | 23601 viewsHow To Plot A Distance-Time Graph?

02:52 | 6347 viewsDrawing A Distance Time Graph

02:52 | 6350 viewsHigh Efficiency Water Electrolysis in Al ...

02:33 | 3906 viewsLec 4 - Allocative Efficiency and Margina ...

14:10 | 3073 viewsSixty symbols - demo on ropulsion efficiency

06:01 | 2745 viewsNo content is added to this lecture.

This video is a part of a lecture series from of Yale

Lecture list for this course

Lec 2- Utilities, Endowments, and Equilibrium

Lec 5- Present Value Prices and the Real Rate of Interest

Lec 6 - Irving Fisher's Impatience Theory of Interest

Lec 7 - Shakespeare's Merchant of Venice and Collateral, Present Value and the Vocabulary of Finance

Lec 8 - How a Long-Lived Institution Figures an Annual Budget. Yield

Lec 10 - Dynamic Present Value

Lec 12 - Overlapping Generations Models of the Economy

Lec 13 - Demography and Asset Pricing: Will the Stock Market Decline when the Baby Boomers Retire?

Lec 14 - Quantifying Uncertainty and Risk

Lec 15 - Uncertainty and the Rational Expectations Hypothesis

Lec 16 - Backward Induction and Optimal Stopping Times

Lec 17 - Callable Bonds and the Mortgage Prepayment Option

Lec 18 - Modeling Mortgage Prepayments and Valuing Mortgages

Lec 19 - History of the Mortgage Market: A Personal Narrative

Lec 21 - Dynamic Hedging and Average Life

Lec 22 - Risk Aversion and the Capital Asset Pricing Theorem

Lec 23 - The Mutual Fund Theorem and Covariance Pricing Theorems

Lec 24 - Risk, Return, and Social Security

Lec 25 - The Leverage Cycle and the Subprime Mortgage Crisis